From Delegate Kathy Szeliga:

Your Hard Work is Paying Off … But We Cannot Quit Yet!

Due to the outcry of people like you and me it appears as though the O’Malley-Brown Gas Tax proposal is being taken off the table! Your letters, e-mails, phone calls and rallies have paid off and together we think we have defeated this outrageous tax….. for now.

Thanks to you and the realtors the highly controversial elimination of the mortgage tax deduction is now off the table too! I have said from the beginning that this deduction is one of the most important things to MD homeowners. Thanks to the Maryland Realtors and homeowners for your hard work in helping to most likely defeat this measure!

The O’Malley-Brown Administration is now looking for “new” taxes to impose. The current proposal is to raise $400 million dollars through an INCOME TAX INCREASE! Obviously the Governor didn’t listen to us in January when 96% of Marylanders said they pay enough in taxes.

You can see our work is not done yet. We need to keep the pressure on the Governor that Marylanders are not OK with increased taxes of any type! I continue to advocate for cuts in the budget and will not support any new tax or fee on Marylanders.

Why Oh Why Does O’Malley-Brown NEED to Raise Your Taxes?

In 2008 and 2009, Maryland’s personal income and wage and salary income growth were both negative – below 0%. This is because we were all making less money due to job losses, lay-offs, furloughs, reduced hours worked, and business income significantly down.

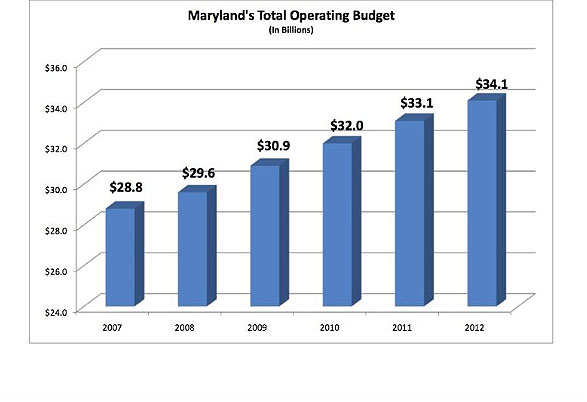

From 2007 – 2009, our economy was officially in a recession. While Maryland families were tightening their belts and forced to reduce family budgets, the Maryland State budget grew and grew. The State budget has increased by over $1 Billion each and every year since O’Malley took office.

$28.2 Billion 2007 state budget

$35.5 Billion projected for next year

$7.3 Billion increase = 26% increase

With personal income down, businesses scaling back, and everyone squeezing each and every dollar, the State is getting less and less from us taxpayers. Instead of looking for reductions in the State budget because their revenues are declining, they are looking for new ways to tax Marylanders.

Unless the leadership in Annapolis will support a level funded budget – or better yet an overall budget reduction, they MUST RAISE YOUR TAXES. The math just doesn’t work. The State cannot continue to expand State spending without getting the money from somewhere.

INCREASED SPENDING = INCREASED TAXES FOR YOU AND ME

The Minority Party introduces a budget solution every year. Unfortunately, our budget plan is rejected year after year. We will, however, continue to present reasonable solutions to Maryland’s budget problems.

What Can You Expect Regarding Tax Increases?

Last year, the leadership in Annapolis brought out a 50% increase in the alcohol tax just two days before the legislative session ended. It was rammed through, largely along party lines. I fully expect something like that to happen again.

Only time will tell. The legislative session ends on April 9th and the magic tax solution may not be known until then. I’m working hard to guard your wallet – but as Mark Twain once said:

“No man’s life, liberty, or property is safe while the legislature is in session.” (1866)

Redistricting Finalized

Every 10 years, following the U.S. Census, Maryland redraws the Congressional and Legislative districts. The Congressional map was presented and voted on during the October 2011 special session. The Governor manipulated this process and gerrymandered the districts to target Roscoe Bartlett (R) in Western Maryland. Though this map was challenged in court it was dismissed and has now become law. Click here and then “launch the interactive map” and insert your address to find out who is on your ballot for the April 3rd Primary Election (yes, this April).

When the General Assembly reconvened in January the Governor presented the redrawn Legislative map. Similar to the Congressional map, the districts seem to be drawn to protect Democrat incumbents. The map had 45 days from when it was presented to be addressed in the General Assembly. There were alternative maps presented, but none were given consideration and thus the Governor’s bill became law. There is a possibility that the legislative map may be challenged in court. These new districts will not be in place until 2014.

The new 7th District stretches from the Pennsylvania line in both Baltimore and Harford Counties, goes through Fallston and Bel Air on its way to Essex. It is geographically huge but I am proud and excited about the opportunity to represent the additions to my district after the 2014 election. Be sure to check Click here and “launch the interactive map” to see if your district has changed.

This summer I’m looking forward to exploring the new parts of the 7th district with my husband, Mark, on our motorcycles. And after Thursday’s weather, I know we are all hoping summer isn’t far off.

Thank you for your thoughts and prayers. Please keep them coming my way.

Kathy

Delegate Kathy Szeliga

It’s easier to take more and more money from tax payers than to make the tough decisions to cut the budget. Any idiot can increase the budget. But then again, it must be so taxing to decide the new ways they are going to take our money and still get elected!!!

O’Malley has nothing to lose…he can’t run for governor. He must want to be President!!! God help us all!!!!!!

“Any idiot can increase the budget” is what KAZ wrote. Any idiot can pontificate when they don’t have enough information to make decisions that they weren’t elected to do is what I believe.

The dems never met a tax they didn’t like. All though O’Malley is eying higher office Miller and Busch can and will run again. And I’ll bet they win again. They have been doing the same dance for years and the voters of their districts keep putting them back in office. Just goes to show you get what you vote for. So much for life in Moscow on the Bay ( Annapolis ).

Why, of why, did Ehrlich-Steele NEED to raise taxes and fees as well as raid various states funds so he could create an artificial surplus that would be gone by the time the next budget rolled around? Oh, yeah. it’s because Ehrlich sucks and he was a lousy governor.

Tom Myers

Young Democrats of Harford County

Tom you are truly clueless… There is no let me repeat that NO defending Owe’Malley. He has done nothing but ruin this state in the last several years. Did you know that Maryland residents are leaving for neighboring states at a record pace? Why is this? Because of the unbelievable taxes in this liberal state.

Get a clue

Ehrlich did suck, AND he was a lousy governor. All he did was raise taxes and fees, AND start the Bay Restoration Fund (aka “Flush Tax”), and fight with the majority party, then whine whenever he didn’t get his way (which was most of the time…”thank god”!) He’s now reduced to defending his cronies that are being convicted of voter fraud (Hensen, Shurick, Etc.) and writing a weekly column in the “liberal” Baltimore Sun. Nice going Bobby! You plod along at those hobbies, while Governor O’Malley continues to repair your mistakes (and those of George W!). If we’re lucky, we’ll have a U.S. President from Maryland come 2016! 🙂

Yes! Tom is still writing comedy!

I just have to say, this has to be some of your best stuff yet.

Please stop – my sides are hurting from laughing so hard!

Dear God Tom, do you actually believe that crap? Are you just repeating what the big boys told yo to owrite?

More budget + more dependence = more power

O’Malley is nothing but a miniature Obama. He is following the same path, but the reality is that Maryland is such a small state that you can live in Virginia, Pennsylvania, and Delaware and still work in Maryland. I get such satisfaction driving home to Pennsylvania from Maryland knowing that I have earned money there, and the Democrats will never get their hands on one penny. That’s called voting with your feet.

Maybe you should deal with PA issues like the Local Tax Enabling Law since you no longer live here.

Aren’t PA taxes higher than MD’s when you factor in all the wage taxes, school taxes and other stuff? Additionally, the commute is probably much longer and costly than if you reside in MD. Are PA schools as good as those in MD? Remember, you can still deduct the mortgage interest even if your home is a bit more expensive in MD than PA.

Having lived in Pennsylvania I can say that there are many more taxes there than here. County income taxes, state income taxes, earned income taxes by township/city, working in Philly you had to pay a wage tax and as an independent contractor I was required to purchase a state business license and a yearly township business license. When we moved here I was really surprised at how much cheaper it was. Schools in PA were about the same as here. Not great, but OK.

This state is going the way of Obama. The state government’s power will increase as the dependence on government increases. This is accomplished by taking as much money from the people as they can. O’Malley is a totalitarian and is goerning through confiscatorry taxation and fees.

TO ALL ELECTED GOVERNMENT OFFICIALS: PLEASE NOTE —

Stop taxing us and start cutting freebie programs, as well as your salary. We didn’t elect you to get fat off taxing us. We elected you in hopes you would turn things around (no not the change Obama claimed). The American people are sick and tired of the government’s handling of the budget.

After 30 years of living and actually PAYING TAXES I must admit defeat. My wife & I are actively looking to move elsewhere as I can no longer abide by those who PAY NO TAXES telling us who do what should be done. I ask all of you, when your bills exceed your income what do you do? The obvious answer is reduce your expenses. It reminds me of the saying “The Beatings will continue to the Morale Improves”. I’m sure PTBL and his boyfriend Porter will have some snarky remark about me being a Tea Bagger….Oh Well Enough is Enough

Regular dude… The taxes for schools are higher but income tax is much lower. To compare home price look at Ryan homes at Kelly glen in hickory and compare them to tge exact same model at russets farm in shrewsbury… The ate 150k cheaper in pa. Factor that in with lower income tax and having a republican governor and I too am outta here